Little Known Facts About Clark Wealth Partners.

Table of ContentsThe Basic Principles Of Clark Wealth Partners How Clark Wealth Partners can Save You Time, Stress, and Money.Some Known Factual Statements About Clark Wealth Partners Clark Wealth Partners Fundamentals ExplainedGet This Report on Clark Wealth PartnersAn Unbiased View of Clark Wealth PartnersThe Basic Principles Of Clark Wealth Partners

These are specialists that supply investment recommendations and are registered with the SEC or their state's safeties regulator. NSSAs can help senior citizens choose regarding their Social Protection advantages. Financial consultants can additionally specialize, such as in trainee car loans, senior needs, taxes, insurance and other facets of your funds. The certifications needed for these specializeds can differ.However not constantly. Fiduciaries are legally required to act in their customer's benefits and to maintain their cash and home different from various other possessions they handle. Only monetary experts whose designation needs a fiduciary dutylike qualified financial coordinators, for instancecan say the very same. This distinction additionally implies that fiduciary and financial expert charge structures differ as well.

Indicators on Clark Wealth Partners You Need To Know

If they are fee-only, they're more likely to be a fiduciary. Lots of qualifications and designations need a fiduciary obligation.

Choosing a fiduciary will certainly ensure you aren't guided toward specific investments because of the payment they supply - financial advisors Ofallon illinois. With great deals of cash on the line, you might want an economic specialist that is legitimately bound to use those funds meticulously and only in your benefits. Non-fiduciaries may suggest investment products that are best for their wallets and not your investing goals

About Clark Wealth Partners

Find out more currently on how to maintain your life and savings in balance. Rise in cost savings the average family saw that dealt with an economic advisor for 15 years or even more contrasted to a similar household without an economic advisor. Resource: Claude Montmarquette & Alexandre Prud'homme, 2020. "Extra on the Worth of Financial Advisors," CIRANO Job Reports 2020rp-04, CIRANO.

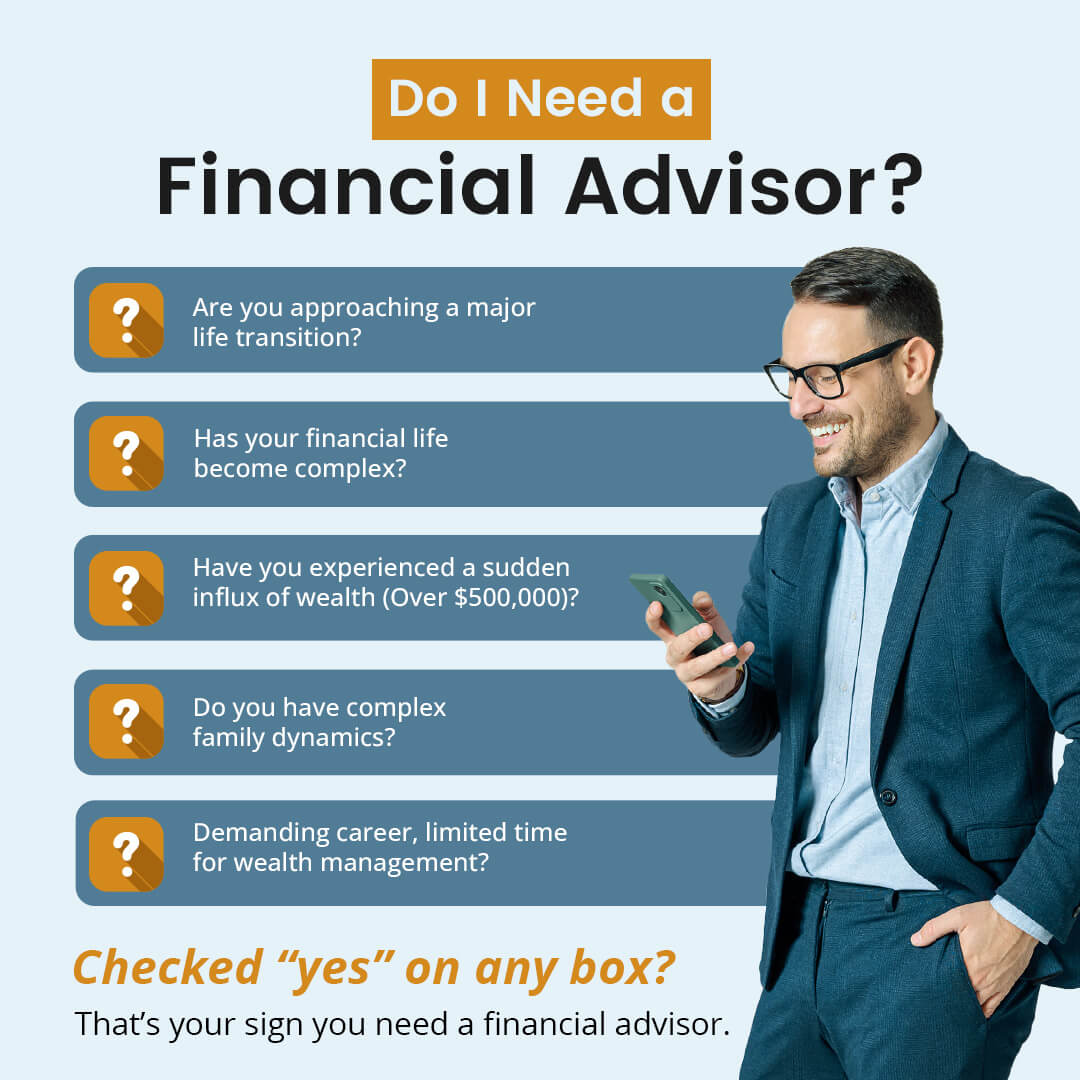

Financial suggestions can be helpful at turning points in your life. When you fulfill with a consultant for the very first time, work out what you want to get from the recommendations.

Get This Report about Clark Wealth Partners

Once you've agreed to go ahead, your economic consultant will prepare a monetary plan for you. You must always really feel comfy with your advisor and their advice.

Insist that you are informed of all deals, and that you get all correspondence relevant to the account. Your adviser might suggest a handled discretionary account (MDA) as a means of handling your investments. This entails authorizing a contract (MDA contract) so they can acquire or market investments without having to contact you.

Some Known Details About Clark Wealth Partners

Prior to you spend in an MDA, contrast the benefits to the expenses and threats. To secure your cash: Don't offer your adviser power of attorney. Never ever authorize a blank document. Place a time frame on any authority you give to acquire and sell financial investments in your place. Insist all document about your investments are sent out to you, not simply your adviser.

This may occur during the meeting or digitally. When you get in or renew the ongoing cost setup with your consultant, they need to define just how to finish your connection with them. If you're relocating to a new adviser, you'll require to arrange to move your economic documents to them. If you require aid, ask your advisor to explain the process.

To load their shoes, the country will require even more than 100,000 brand-new economic consultants to get in the market.

Clark Wealth Partners - The Facts

Helping individuals attain their monetary goals is an economic advisor's main feature. Yet they are also a small company proprietor, and a part of their time is committed to managing their branch workplace. As the leader of their practice, Edward Jones economic advisors require the management skills to hire and handle team, as well as business acumen to develop and execute an organization technique.

Spending is not a "set it a knockout post and neglect it" activity.

Financial experts must schedule time each week to fulfill brand-new people and overtake the individuals in their ball. The economic services sector is heavily controlled, and policies change frequently - https://myxwiki.org/xwiki/bin/view/XWiki/clrkwlthprtnr?category=profile. Several independent financial experts spend one to 2 hours a day on conformity tasks. Edward Jones financial advisors are fortunate the home office does the heavy lifting for them.

A Biased View of Clark Wealth Partners

Edward Jones financial experts are encouraged to pursue additional training to widen their knowledge and skills. It's likewise a good concept for economic advisors to go to industry seminars.